Small Bite Learning

Small Bite Learning

Never Stop Learning It Pays To Be Informed

Small Bite Learning

It Pays To Be Informed

Never Stop Learning

How Are Your St. John’s, NL Residential And Commercial Taxes Determined?

The Assessment Cycle

For assessment and ultimately taxation, the City of St. John’s determines the market value of all properties as of a single date, known as the base date.

The city, which has its own assessment division, defines market value as: “The most probable price, as of the base date, for which a property would sell after reasonable exposure in a competitive market, with a willing buyer and seller acting prudently, knowledgeably and for self-interest, assuming that neither is under duress.”

Mass Appraisal Approach

As stated on its website, the City uses a mass appraisal approach, which values all properties as of a base date using standardized models. These models draw on:

- Recent sales data

- Property characteristics (e.g., square footage, age, lot size)

- Neighborhood trends

- Adjustments based on market conditions

This process does not always involve annual onsite inspections, but instead uses digital records, building permits, aerial imagery, and other data sources to track changes.

Assessed Value Often Different From Market Value

It is important to understand that the assessed value of a property at the base date may be, and often is, quite different from what the property would actually sell for in an open market transaction at the time of the assessment and during the subsequent two years during which the assessment is in effect.

That is because the city’s valuation of a property, which is often referred to as a notional market valuation, is based on certain criteria, some of which may not be present if the property was sold in an open market transaction. For example, in an open market transaction, one or both of the buyer and seller may not act prudently and either the buyer or seller may be under duress to purchase or sell. A seller under duress for financial, health or other reasons may be prepared to sell for less than the normal market value of the property; whereas a buyer desperate for accommodations may be prepared to pay more for a property than its real market value.

The base date for the 2024 and 2025 assessment was January 1, 2022. The base date for the 2026 and 2027 assessment is January 1, 2024.

You should have received your 2026 property assessment notice in May of this year.

Remember, that the value of your property, as stated on the assessment notice, is as of the January 1, 2024 base date – not necessarily what the market value of your property is today.

Note that, while St. John’s has its own assessment division, property assessments for the cities of Corner Brook and Mount Pearl and all other municipalities throughout the province, are undertaken by the Newfoundland and Labrador Municipal Assessment Agency (MAA)

Residential Taxes

Your annual residential tax bill is comprised of three, components, as follows:

- Assessed Value: This is the market value of your property as of a specific “base date,” determined by the City’s Assessment Division using a mass appraisal process.

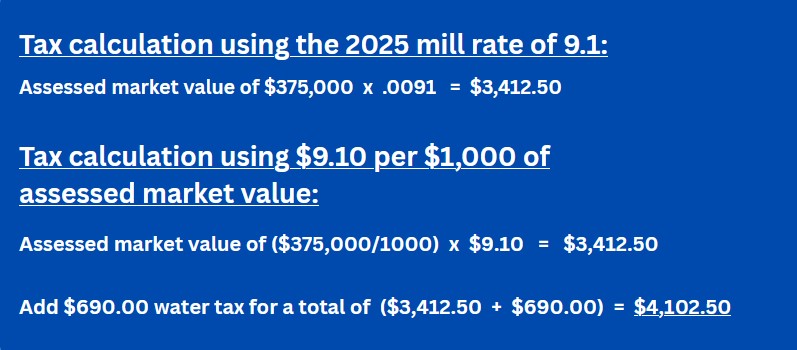

- Mill Rate: The mill rate (or tax rate) is set annually by the City Council as part of the budget process. It is expressed in “mills,” where one mill is equal to one-tenth of a cent (or 0.001) for every dollar of assessed value. The mill rate for residential properties in 2024 and 2025 is 9.1 mills for every dollar of assessed value (or 0.0091).For those who prefer to think in tems of dollars and cents, the current mill rate of 9.1 equates to $9.10 for every $1,000.00 of assessed value.

- Water Tax: This is a separate, fixed fee applied on a per-unit basis, which is also set annually by the City Council. For example, the water tax for a single-family dwelling in 2025 is $690.

2025 Residential Tax Rates with comparative rates for 2023 and 2024

| Category | 2025 | 2024 | 2023 |

|---|---|---|---|

| With water & sewer services | 9.1 mills | 9.1 mills | 8.3 mills |

| With either water or sewer services | 8.6 mills | 8.6 mills | 7.8 mills |

| Without water & sewer services | 8.1 mills | 8.1 mills | 7.3 mills |

| Vacant Land | 9.1 mills | 9.1 mills | 8.3 mills |

| Senior Citizens (GIS recipents) | 25% reduction | 25% reduction | 25% reduction |

| Water tax* | $690.00 | $675.00 | $670.00 |

*Single Family Residence

There are a number of ways to calculate your taxes for a given year. Two simple ways are provided below, using a single-family residential property with an assssed market value of $375,000 as an example.

COMMERCIAL TAXES

Prior to 2013, St. John’s imposed both a Commercial Realty Tax and a Business Occupancy Tax. If a property owner also operated a business from the property, the owner was responsible for both taxes. However, if the property was leased, the city billed the tenant directly for the Business Occupancy Tax.

However, the city discontinued the Business Occupancy Tax effective January 1, 2013.

According to the city, this tax was eliminated to create a more streamlined and efficient tax approach.

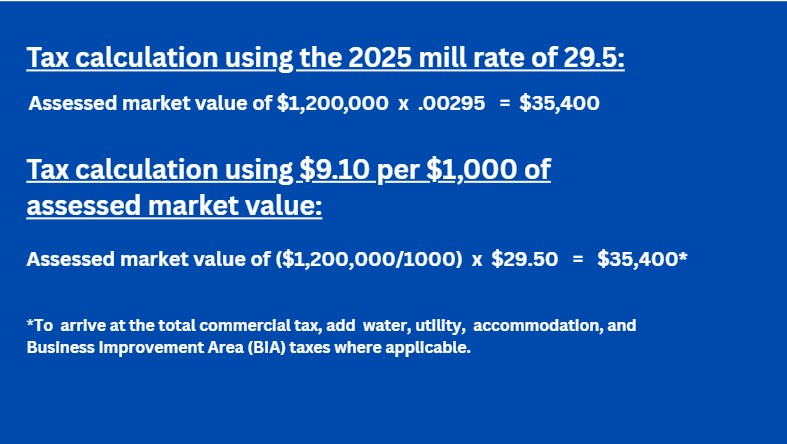

Determining the market value of a commercial property for use in calculating the Commercial Realty Tax is relatively straightforward.

However, determining the fair market value of each business for use in determining its Business Occupancy Tax, when this tax was in use prior to 2013, would have been much more time consuming and a much greater challenge for the city, even by using a fairly simple metric such as Gross Revenue as part of the calculation.

Furthermore, as pointed out by the city at the time of the change, many business opened and closed quickly without paying the levy, making collection difficult.

In case you’re wondering how the city dealt with the loss of revenue from eleminating the Business Occupancy Tax. Easy solution; it simply increased the mill rate on the Commercial Realty Tax sufficient to cover the amount of tax that would have otherwise been collected from the Business Occupancy Tax.

2025 Commercial Tax Rates with Commparative Rates for 2023 and 2024

| Category | 2025 | 2024 | 2023 |

|---|---|---|---|

| With water & sewer services | 29.5 mills | 29.5 mills | 26.9 mills |

| With either water or sewer services | 29.0 mills | 29.0 mills | 26.4 mills |

| Without water & sewer services | 28.5 mills | 28.1 mills | 25.9 mills |

| Vacant Land | 14.75 mills | 14.75 mills | 13.45 mills |

| Utility tax | 2.5% – gross revenue | 2.5% – gross revenue | 2.5% – gross revenue |

| Accommodation tax (1) | 4% of the amount charged for lodging | 4% of the amount charged for lodging | 4% of the amount charged for lodging |

| Business Improvement Area (BIA) downtown development area only | 0.8 of a mill added to the commercial mill rate (levy) | 0.8 of a mill added to the commercial mill rate (levy) | 0.8 of a mill added to the commercial mill rate (levy) |

| Water tax (2) | $690.00 | $675.00 | $670.00 |

(1) Hotels and other establishments in St. John’s, that provide accommodations, are required to collect the 4% accommodation tax from guests and subsequently remit it to the City.

(2) According to the city, most commercial properties in the city, such as office buildings and retail spaces are on a metered system and pay on the basis of water usage.

Below are two simple ways to calculate the Commercial Realty Tax, using a commercial property with an assesed market value of $1,200,000 as an example.

I trust that this relatively short post gives you some insight into residential and commercial property assessments, and the application of mill rates in calculating your annual property taxes.

While this post places particular emphases on the city of St. John’s, the mill rate calculations apply to all cities and towns in the province that uses it in calculating their residential and commercial property taxes.

In the meantime, if you would like to increase your knowledge and understanding of residential and commercial real estate, especially with regard to business and commercial real estate valuations, please contact me for an absolutely free, personal and confidential consultation.

I can be reached at: